About us

”Mesaba” has two primary meanings, both linked to the Mesabi Iron Range in Minnesota. It is the name of the range itself, which is derived from the Ojibwe Language. The Ojibwe word means either “Soaring Eagle” or “Giant’s Mountain”, depending on the context.

Mesaba Capital Partners (MCP) is a fully-integrated real estate development fund focused on partnering with industry leading architects, contractors and operators to build and operate top-line facilities for its clients and ownership partners. MCP and its team of partners have developed over $1.0 Billion in projects the past 10 years, consisting of over 100 projects and 7,700 Senior Living units. Our team has raised over $400MM in prior Senior Living focused funds and transacted over $2B in debt solutions within the Senior Housing sector.

Mesaba in the News:

This recent article highlights the equity fundraising for senior living communities, coming soon to Lebanon, Cookeville, and Knoxville, Tennessee!

This recent article highlights Mesaba Capital completing the equity fundraising for three senior living communities, which are set to break ground in 2025.

Senior housing is so scarce that many older adults are buying before they even need it – MarketWatch

This recent article highlights the growing demand for senior housing — a sector where Mesaba Capital continues to lead strategic investments.

Investment strategy

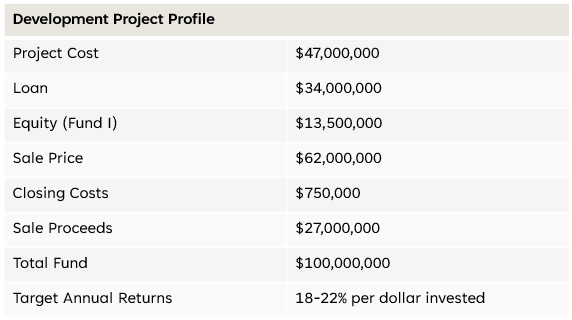

- Initial fund raise minimum of $100M and up to $120M for development investments in thoroughly researched markets. The initial fund investment will have a five-year term.

- Shovel ready projects have already been identified which will provide significant time savings from the start

- Minimum investment of $5M for institutional investors and $1M for individual investors will ensure a quality mix of investment partners

- Professionally managed fund with support to provide investors with institutional level reporting and analysis.

- Demographic-driven demand with demand for seniors housing currently exceeding supply by 4x there is significant opportunity for investment in new Senior Living developments especially in senior friendly locations

- New project developments will be primarily focused in the Sun Belt markets with approximately 130 units in Independent Living, Assisted Living, and Memory care facilities providing for consistent, repeatable, and operationally-focused investments

Market Conditions

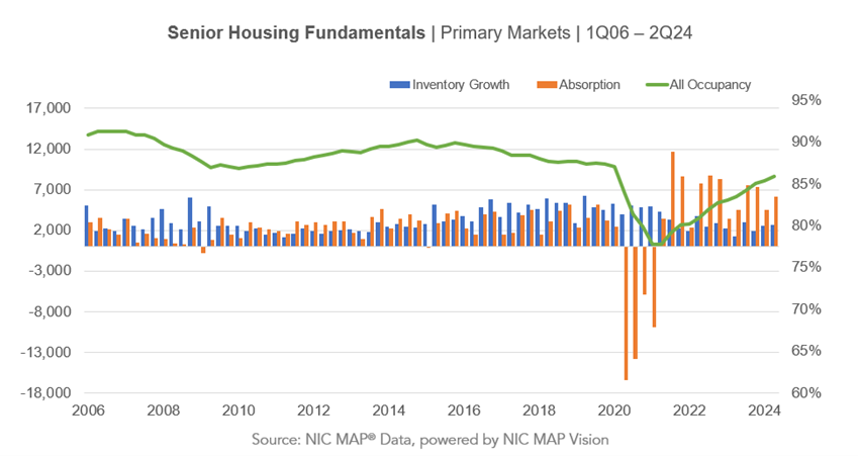

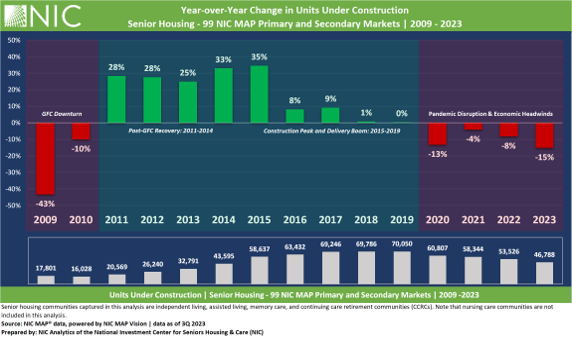

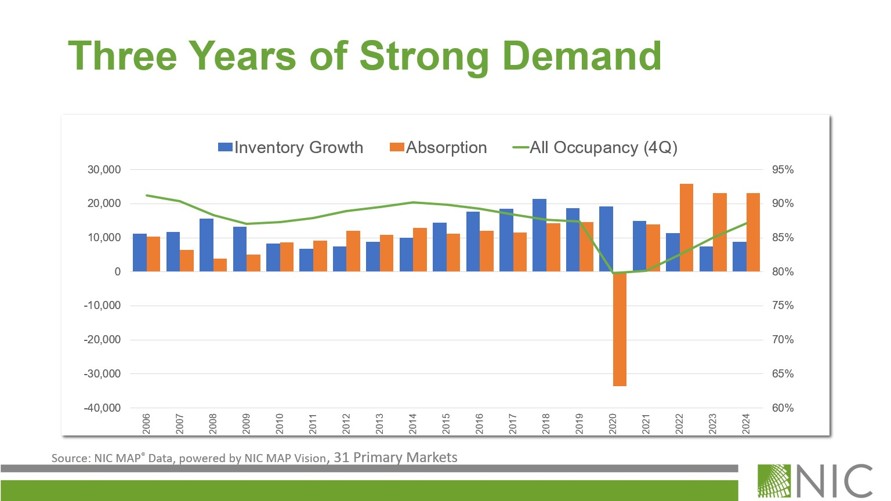

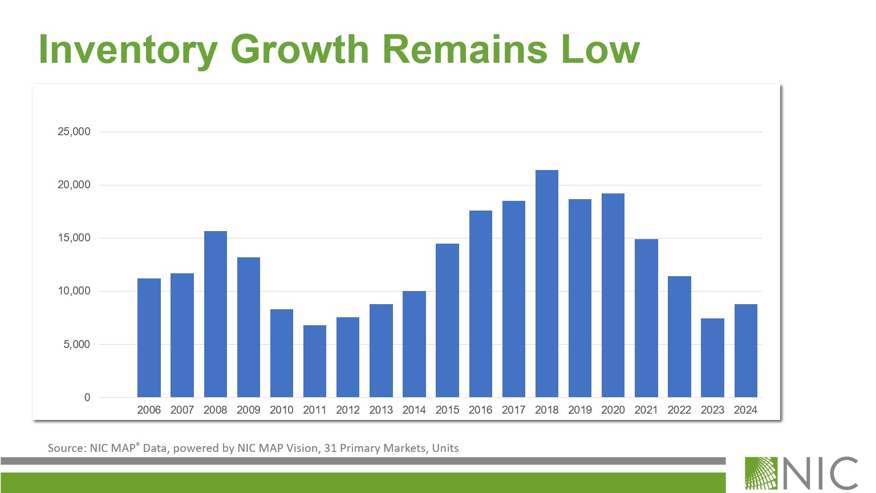

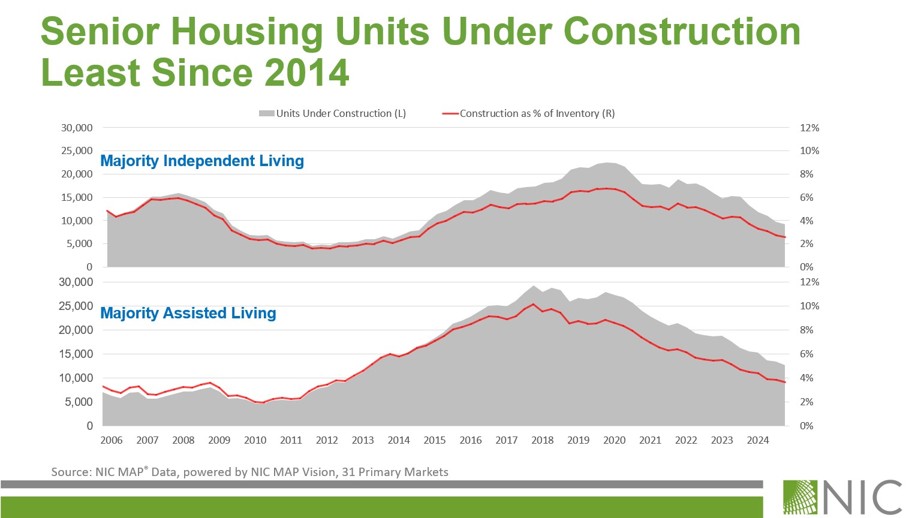

Senior Living is absorbing units at the fastest rate in modern history. Current national occupancy for senior housing is at an all-time high with an average occupancy of 88%. Senior living demand current exceeds supply by more than 4X the current supply Senior Housing has increased in occupancy for the last 12 consecutive quarters. 2024 had the lowest number of Senior Living units developed since the 1st quarter of 2009. There will be a minimum shortage of 550,000 Senior Living units by 2030 (could be as much as 675,000 units short)

Source Graph 1) Senior Housing Occupancy Increases for Twelfth Consecutive Quarter in Second Quarter 2024 – National Investment Center

Population Fundamentals

- Currently 1 in 6 people living in the U.S. are over the age of 65.

- By 2030; all baby boomers will be 65 or older fueling a consistent demand in this sector.

- 66% growth in 80+ population, 44% growth in 75+ population

- As of 2022 the population in the United States aged 65 or older represent 58M adults; this will increase by 48% to create a population size of 82M adults over 65 by 2050.

- By 2034 the amount of 65 and older will represent a larger population than all children in the United States which is the first time in US history older adults outnumber children.

- From 2010-2020 the population of 65-74 increased by 54%; this will again double by 2030.

- Minimum $275B of projected cost to cover the construction shortfall

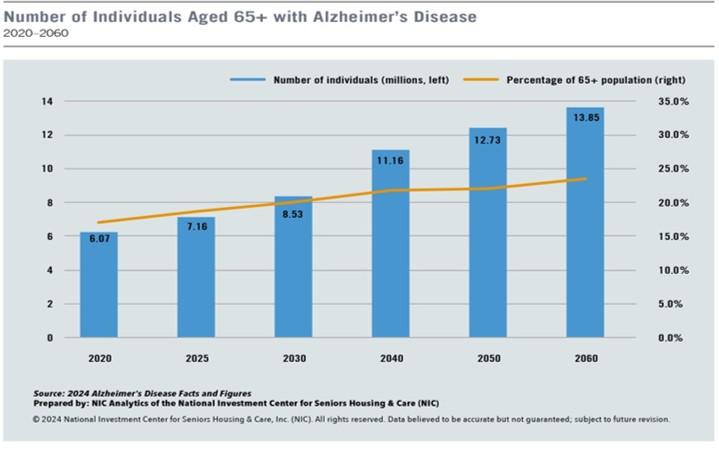

Growing Memory Care Needs

Deal Overview

Exit Strategy

Exit Strategy for Investors

- Sale of Asset in year 4/5. Assuming a 2-year construction period with a 18-month lease-up period asset would be ready to divest by the end of year 4.

- Refinance via Bank debt to payback investors while obtaining more time for proper exit strategy to unfold. Assets will net full Loan-to-Cost

- Agency Exit: The assets will be able to use all 3 major government backed exits including Fannie Mae, Freddie Mac, and FHA/HUD

- Own/Operate – Bring in new long-term investors such as Private Equity or Investment Banks looking to add cash flowing positive assets

- General Partners will purchase the asset for hold

Kirkland is a global law firm that serves a broad range of clients in corporate transactions, litigation, restructurings and intellectual property matters.

CPAs, Accounting and Consulting Services | Abdo

Meet Abdo. A team of CPAs and advisors providing accounting, outsourcing, and consulting services to individuals, businesses, nonprofits and governments.

Petra Funds Group | Private Equity Fund Administrator

Petra Funds Group offers tailored fund solutions to private equity and private debt funds including fund administration, regulatory compliance, launch advisory, ESG advisory, and management company accounting. With extensive in-house experience, our expert team propels your fund forward

Copyright © Mesaba Capital Partners

34522 North Scottsdale Road suite 120-638

Scottsdale, AZ

Phone: 651-324-9492